In today’s fast-paced financial world, simply letting your money sit in a bank account is no longer enough. Inflation, low interest rates, and missed opportunities mean that idle cash is effectively losing value. That’s where the concept of Cyclemoneyco Cash Around comes in — a modern approach to cash management that keeps your money active, productive, and accessible.

Whether you are an individual looking to optimize personal finances or a small business aiming to improve cash flow, understanding this approach can transform how you handle your funds.

What Is Cyclemoneyco Cash Around?

Cyclemoneyco Cash Around is a method of strategically moving your money across accounts, investments, and bills to maximize its efficiency. Instead of letting cash sit idle in checking or low-interest savings accounts, this approach focuses on keeping it in motion, earning returns, and remaining liquid.

Think of your money as a wheel: the faster and smarter it turns, the more value it generates. By using automated tools and financial strategies, Cyclemoneyco helps ensure that cash is constantly circulating — without compromising security or accessibility.

Why Cash Around Matters

Traditional banking often discourages frequent cash movement. Savings accounts pay minimal interest, checking accounts earn almost nothing, and delayed transfers can freeze your funds for days.

Cyclemoneyco Cash Around addresses these issues by:

- Maximizing Returns: By cycling money into short-term high-yield accounts or investments, your funds can earn more than sitting idle.

- Improving Liquidity: Your cash remains accessible for emergencies or operational needs.

- Reducing Idle Time: Minimizes periods when your money isn’t generating value.

- Promoting Financial Discipline: Encourages planned, intentional cash movement across accounts.

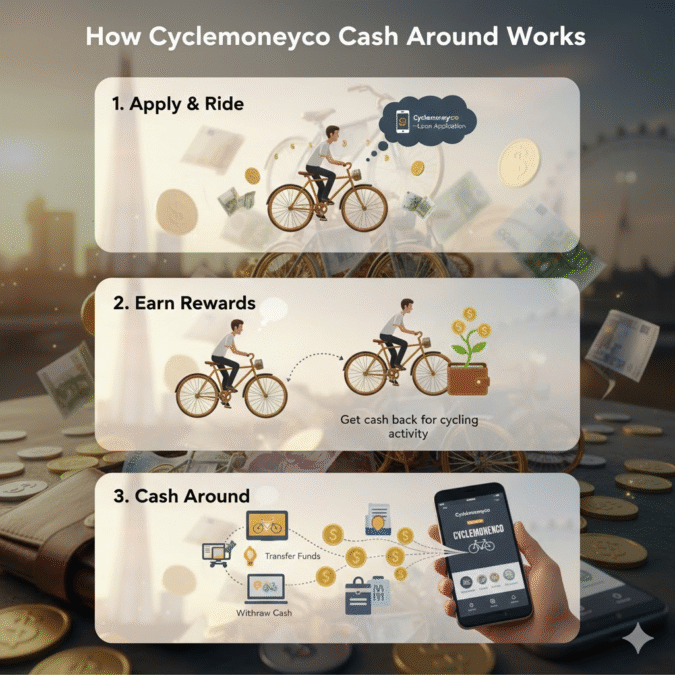

How Cyclemoneyco Cash Around Works

The process is simple yet effective, especially when automated:

Step 1: Link Your Accounts

Connect your checking, savings, digital wallets, and investment accounts to create a clear overview of your finances.

Step 2: Set Rules

Decide how and when your money moves. For example:

- Excess checking funds automatically move to savings weekly.

- Savings rotate into short-term investments periodically.

- Emergency cash always remains liquid.

Step 3: Automate Transfers

Automation ensures that your cash moves efficiently without requiring manual intervention.

Step 4: Monitor and Adjust

Dashboards and tracking tools let you monitor performance and tweak strategies as needed.

Benefits of Cyclemoneyco Cash Around

- Better Cash Flow: Ideal for businesses managing payables, receivables, and payroll.

- Higher Returns: Idle money starts generating income through smart allocation.

- Accessibility: Cash remains easy to access for emergencies.

- Financial Control: Helps you proactively manage finances instead of reacting to events.

Common Misconceptions

- It’s a “Get Rich Quick” Scheme: False. It’s about optimizing cash circulation, not instant wealth.

- Only for Large Investors: False. Anyone can start small and gradually scale.

- Too Complex for Beginners: Modern fintech apps simplify the setup, even for novices.

Risks and Precautions

- Market Volatility: Investments used in the cash cycle can fluctuate.

- Over-Circulation: Don’t risk all funds; maintain an emergency buffer.

- Security: Only use trusted, regulated platforms.

- Misinformation: Avoid platforms that make unrealistic claims about returns.

Who Can Benefit Most?

- Individuals: Freelancers or anyone looking to make their cash productive.

- Small Businesses: Companies needing liquidity and efficient cash flow management.

Tips to Get Started

- Track your income and expenses first.

- Set simple automation rules for cash movement.

- Keep a separate emergency fund.

- Monitor and adjust your system monthly.

Cyclemoneyco Cash Around vs Traditional Banking

| Feature | Traditional Banking | Cyclemoneyco Cash Around |

| Money Movement | Manual | Automated, dynamic |

| Returns | Low | Higher with rotation |

| Accessibility | Good | Good + optimized |

| Automation | Limited | Built-in |

| Financial Visibility | Basic | Advanced dashboards |

FAQs

1. Is Cyclemoneyco Cash Around Legit?

Yes, it’s a concept focused on optimizing cash flow. Use trusted financial tools to implement it safely.

2. Can Anyone Use It?

Yes, it suits both individuals and small businesses with clear cash flow goals.

3. Do I Need Special Software?

Not necessarily, but automation apps simplify the process.

4. Is It Better Than Traditional Saving?

For many, yes — because it makes money more productive while keeping it accessible.

5. Can This Improve Business Cash Flow?

Absolutely. Efficient cash movement supports bills, payroll, and investments.

Final Thoughts

Cyclemoneyco Cash Around is a modern, practical approach to money management. By keeping funds in motion and using automation, it helps your money work smarter for you — whether for personal growth or business efficiency.

With proper planning, caution, and reliable tools, this strategy can turn idle cash into a dynamic financial asset.